What is a Risk Register? What are its Key Elements?

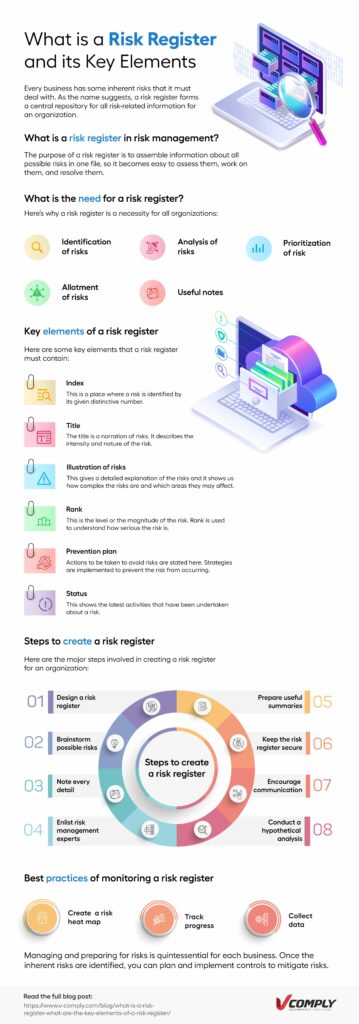

Every business has some inherent risks that it must deal with. As the name suggests, a risk register forms a central repository for all risk-related information for an organization. This includes the type of risks, the impact they may have on an organization, and the risk management plans of the company.

Key takeaways (TL;DR)

- Learn how a risk register identifies, analyzes, and prioritizes organizational risks.

- Discover essential elements every effective risk register must include for success.

- Understand how to create, maintain, and secure a detailed risk register.

- Explore best practices for monitoring progress and building insightful risk heat maps.

- Get insights on using VComply to centralize and automate risk registers.

In this article, we’ll take an in-depth look at what a risk register is, and how it helps companies manage risks.

What is a risk register in risk management?

A risk register is a repository or a document that contains details about potential risks in an organization. It describes the risk as a whole, the category under which it falls, the potential impact of the risk, etc. In addition, it is an instrument in project management and risk management that helps recognize and mitigate potential risks. It also lists precautionary steps an organization can take to overcome these issues.

The purpose of the register is to assemble information about all possible risks in one file, so it becomes easy to assess them, work on them, and resolve them.

What is the need for a risk register?

A risk register lists all potential risks associated with an organization. Here’s why a risk register is a necessity for all organizations:

-

Identification of risks

A risk register helps identify the various types of risks associated with a business, enterprise, or project. A dedicated team generally conducts an in-depth investigation of factors that will affect the organization such as weather, resources, or market, and makes a note of these in the register.

-

Analysis of risks

The risk register shows the impact of each risk and when it may occur. This helps organizations be prepared at all times.

The recent pandemic has had a detrimental impact on various businesses such as travel, restaurants, and physical stores. It illustrates why constantly analyzing and preparing for potential business risks is of utmost importance.

-

Prioritization of risk

Not all risks are equal. Some need instant actions, while others may not pose an immediate threat to the business. Diligently noting down all potential risks helps businesses prioritize risk in an organized manner. Besides, organizations can classify risks as high, low, or medium priority, and deal with them accordingly.

-

Allotment of risks

To manage risks in a better way, organizations can use the risk register to appoint relevant team members to manage potential risks. Without building this level of accountability, it can be difficult to keep track of risks.

-

Useful notes

The risk register also contains issues that have not been recorded before but may also be of importance. This helps ensure that important information doesn’t slip through the cracks.

Key elements of a risk register

Here are some key elements that a risk register must contain:

-

Index

This is a place where a risk is identified by its given distinctive number. In every project, many risks are entered in the index, even if it is a small project. This helps easily find risks.

-

Title

The title is a narration of risks. It describes the intensity and nature of the risk.

-

Illustration of risks

This gives a detailed explanation of the risks that are mentioned in the risk register.

It shows us how complex the risks are and which areas they may affect. By reading the description, the stakeholders decide on the steps to be taken to mitigate the risk.

-

Rank

This is the level or the magnitude of the risk. Rank is used to understand how serious the risk is. If the consequences of the risk are dangerous, then it should be ranked as a high priority.

-

Prevention plan

Actions to be taken to avoid risks are stated here. Strategies are implemented to prevent the risk from occurring. Each person in charge of the risk should work on avoiding the risk as far as possible.

-

Status

This shows the latest activities that have been undertaken about a risk. It shows the status as completed or pending, along with corresponding dates.

How to create a risk register?

Here are the major steps involved in creating a risk register for an organization:

-

Design a risk register

Ensure that the risk register is updated and has the correct format. This will ensure you get all the relevant information and a clear picture of all the levels of risks associated with a project. It will guide your team to get better results.

-

Brainstorm possible risks

Study and evaluate your plans in a granular manner, to uncover even the smallest risk involved that can harm your efforts. Think of ways that the risks can be avoided or at least reduced in impact.

-

Detailing of risks

The risk register should analyze each risk minutely. It should describe the risk, steps to control it, how to manage the risk if it becomes a reality, and the person accountable for each risk.

-

Enlist risk management experts

With their skills and knowledge, risk management experts can forecast when a risk will appear and what will be its intensity. Some of these experts include investment bankers, and risk and financial analysts. While preparing their risk register, organizations must also seek help from experts to properly identify and evaluate risks.

-

Conduct a hypothetical analysis

The hypothetical analysis is a series of assumptions that may be made in regard to a project. What may go wrong with a project, what will the potential impact be, and what actions can the team take to reduce the impact, these should be part of a hypothetical analysis.

-

Encourage communication

A risk register is not only a tool that records risks and actions to overcome them, but also a communication channel between stakeholders. To make the most of it, a risk register should include varied views and perspectives. Every viewpoint should be considered while taking any decision so that the interest of all the members is intact and unharmed.

-

Keep the register secure

While the participation of all members of an organization should be encouraged, the ability to view and update the register should be limited to a few trusted employees. Only a few stakeholders such as owners of the organization and senior-level managers should be provided rights to edit and audit the risk register.

-

Prepare useful summaries

Senior-level executives may not be able to view every part of the register. Thus, a summary can give them an overall picture of the risks involved, and guide them to take necessary actions.

Best practices of monitoring a risk register

Take a look at the best practices:

-

Track progress

Organizations must continually track their progress, concerning risk management. They must evaluate past actions, present activities, and future goals to ensure the level of risk is kept to a minimum.

-

Collect data

Initially, at the start of the register, there may not be much data available to an organization. As bigger issues start to appear and you gain more experience, make a note of information such as high potential risks, medium risks, and so on. Study your past performance, how you handled risks in the past, and what you can improve on.

-

Create a risk heat map

Accordingly, a risk heat map helps you assess risks in a meaningful way. It shows you the probability of certain risks and what impact they may have on a project.

Wrapping up

We hope this article serves as a starting point for you to create a risk register for your business. Managing and preparing for risks is quintessential for each business. Once the inherent risks are identified, you can plan and implement controls to mitigate risks.

VComply’s risk management software provides a centralized system to determine and maintain a register of potential risks for the organization, and evaluate the impact of the risks, and implement controls for the treatment and mitigation of risks.