What Is The Importance Of The COSO Framework? How Does VComply Help In COSO Framework Management?

COSO framework (The Committee of Sponsoring Organizations) is an integral name in the world of risk management. With the explosion of cyber threats, and exponentially increasing uncertainty from multiple aspects, organizations were in dire need of an integrated risk management framework that could navigate them through the intricacies and uncertainties and that’s how COSO has come into existence.

COSO framework (The Committee of Sponsoring Organizations) is an integral name in the world of risk management. With the explosion of cyber threats, and exponentially increasing uncertainty from multiple aspects, organizations were in dire need of an integrated risk management framework that could navigate them through the intricacies and uncertainties and that’s how COSO has come into existence.

Key takeaways (TL;DR)

- Discover how the COSO Framework strengthens internal controls, risk management, and compliance programs.

- Learn the five key components and 17 actionable principles powering the COSO model.

- Understand why adopting COSO improves fraud detection, governance, and investor confidence.

- Explore best practices for compliance officers to implement COSO effectively across organizations.

- Get insights on how VComply helps automate and streamline COSO implementation for businesses.

It all started when five private sector organizations formed a joint initiative to fight corporate fraud. These organizations were later renamed the COSO, and their first COSO enterprise risk management framework was established in 1992 and accepted by the SEC.

COSO is dedicated to helping organizations’ performance by developing thought leadership that improves internal controls for corporate governance, business ethics, corporate risk management, fraud, and financial reporting.

COSO’s internal control framework defines internal control as a process, performed by the board, senior management, and other personnel of an entity, designed to provide reasonable assurance regarding the achievement of objectives related to operations, reporting, and compliance.

Importance of the COSO framework

COSO framework is widely known among enterprises regarding establishing risk management framework and companies across different domains and sizes have adopted this to improve their internal controls and processes. Not all businesses mandatorily need to embrace the COSO framework but it has undeniable benefits for organizations.

With minor changes in 1994 and 2013, the COSO integrated framework continues to serve as a benchmark for organizations seeking to improve internal audit performance and the overall health of enterprise-wide risk management.

The COSO report continues to provide a solid basis for organizations to make improvements in the following areas:

- Increased expectations of governance oversight

- Advanced complexities in business

- Globalization of operations and markets

- Meeting complex requirements of rules, regulations, laws, and industry standards

- Standard results for industry responsibilities

- Adopting and adapting to evolving technologies

- Expectations related to fraud detection and prevention, along with other effective improvements in enterprise risk management

- Improving the reliability of financial reports

Let’s deep dive into the benefits to understand the importance of the COSO framework.

Why the COSO Framework Matters in 2025

The relevance of COSO has grown in the face of today’s risks and opportunities:

Improved internal controls

Over the past 20 years, countless organizations have failed due to ineffective risk management and related internal controls. According to the COSO board, the updated framework provides companies with more effective internal controls, enabling organizations to better mitigate risk and have the data they need to support informed decision-making. As a leader, you can leverage the 2013 framework to assess how you can improve the effectiveness of your internal controls as well as the overall efficiency of your organization.

Improved cybersecurity

In today’s digital age, businesses face an onslaught of fraudulent activity, cybersecurity threats, and other risks. According to the University of Maryland, a cyberattack happens every 39 seconds, and on average, companies lose $188,400 annually due to cybercrime.

The COSO framework will help organizations put themselves on the right path to face and manage the staggering number of cyberattacks.

Significant cost savings

In a comparative analysis of a study by Robert Half and the Financial Executives Research Foundation, the research arm of Financial Executives International (FEI), more than 50% of executives surveyed in the United States and Canada said they expect that their organization’s compliance costs will increase or stay the same over time.

According to COSO, by correctly implementing the 2013 framework, companies can streamline processes, implement controls, enhance internal measures and reduce compliance costs.

More attention from investors

Now more than ever, investors examine the performance of public companies through the lens of revenue and profits. The key advantage of adopting the 2013 COSO framework is that you have more effective risk management controls. This becomes all the more important for companies that are on the way to getting listed on the stock market or that have already done the IPO.

A COSO report states, “For a public company, stronger corporate governance should translate into stronger business results and increased shareowner value.” As organizations transition to the 2013 framework, they can promote their commitment to integrity, ethical values, and effective internal controls to potential investors.

Improved corporate governance

Poor corporate governance and monitoring of business performance have led to countless corporate failures and lower shareholder values. A fundamental goal of COSO is to improve the corporate governance function within organizations that oversee safety, risk, and compliance programs to ensure adherence to policies, objectives, and laws.

Advanced risk assessments

Most of the time, people think that incidents occur because of employee negligence or error. The truth is, most workplace incidents occur because of inadequate/poor management controls. Your proactive efforts to implement effective risk assessments can prevent most incidents.

Improved fraud detection and prevention

The COSO framework can help organizations improve their effectiveness in managing fraudulent activities. The framework also enables organizations to implement effective and stringent controls that prevent fraud in the first place, detect fraud as soon as it occurs, and respond effectively to incidents of fraud when they do occur.

The 5 Components of the COSO Framework

The COSO Framework is built on five integrated components. Think of them as the building blocks of an effective internal control system:

1. Control Environment

The foundation of internal control, the control environment sets the tone at the top. It reflects the culture, values, and ethical standards of the organization.

Key elements include:

-

Integrity and Ethical Values – clear codes of conduct and leadership commitment to doing the right thing.

-

Board Oversight – an engaged board or audit committee overseeing management actions.

-

Organizational Structure – clarity of roles, responsibilities, and reporting lines.

-

Commitment to Competence – ensuring employees are skilled and trained.

-

Accountability Mechanisms – performance evaluations, disciplinary actions, and incentives aligned with compliance.

Without a strong control environment, even the best-designed policies may fail in execution.

2. Risk Assessment

Organizations must identify and evaluate risks that could impact objectives. Risk assessment under COSO involves:

-

Defining Objectives Clearly – operational, reporting, and compliance goals.

-

Identifying Risks – both internal and external threats.

-

Analyzing Risks – evaluating likelihood and impact.

-

Fraud Considerations – identifying risks of fraud or misconduct.

-

Assessing Change – adapting to new business models, regulations, or technologies.

A good risk assessment process ensures that management proactively anticipates challenges rather than reacting after problems occur.

3. Control Activities

Control activities are the policies, procedures, and practices that mitigate risks. They are the actual actions taken to enforce internal controls.

Examples include:

-

Approvals and Authorizations – requiring sign-off before major transactions.

-

Reconciliations – matching financial records with supporting documentation.

-

Segregation of Duties – ensuring no single person controls all parts of a transaction.

-

Physical Controls – securing assets, access badges, or locked storage.

-

IT Controls – restricting system access, encryption, automated alerts.

Control activities must be consistently applied and integrated into daily business operations, not treated as an afterthought.

4. Information and Communication

For controls to be effective, information must flow seamlessly across the organization. This component emphasizes the quality and timeliness of information:

-

Internal Communication – employees must understand their roles in compliance and control.

-

External Communication – transparent reporting to regulators, investors, and partners.

-

Systems & Technology – leveraging ERP, GRC, or compliance management software to ensure data integrity.

Clear, accurate, and open communication builds trust internally and externally.

5. Monitoring Activities

Monitoring ensures that internal controls remain effective over time. It includes:

-

Ongoing Monitoring – embedded into daily operations, such as automated alerts or dashboards.

-

Separate Evaluations – periodic internal audits, external reviews, or independent testing.

-

Corrective Actions – ensuring identified weaknesses are promptly addressed.

Monitoring closes the loop, providing assurance that the entire system is working as intended.

The 17 Principles of COSO

In 2013, COSO added 17 principles to make the five components more actionable. A few examples include:

-

Demonstrate commitment to integrity and ethical values.

-

Specify suitable objectives.

-

Identify and analyze risk.

-

Develop control activities through policies and procedures.

-

Use relevant information.

-

Conduct ongoing evaluations.

-

Evaluate and communicate deficiencies.

These principles ensure organizations implement COSO in a practical, measurable way.

Benefits of Implementing the COSO Framework

1. Strengthened Risk Management

COSO provides a structured way to identify, assess, and respond to risks across the organization.

2. Enhanced Compliance

By aligning with laws like SOX, COSO helps organizations stay audit-ready and regulator-friendly.

3. Reliable Financial Reporting

Stronger controls reduce errors and improve the accuracy of financial statements.

4. Operational Efficiency

Standardized processes reduce duplication, errors, and inefficiencies.

5. Fraud Prevention and Detection

With clear accountability and monitoring, organizations are better equipped to detect red flags early.

6. Investor Confidence

Adopting COSO signals strong governance practices, boosting stakeholder trust.

Challenges in Applying COSO

Despite its benefits, organizations face challenges such as:

-

Complexity: Implementing all 17 principles can be resource-intensive.

-

Cost: Continuous monitoring and audits require investment.

-

Cultural Resistance: Employees may see internal controls as bureaucratic hurdles.

-

Technology Risks: Digital transformation introduces new control requirements around data and cybersecurity.

Best Practices for Compliance Officers

Compliance officers play a critical role in embedding COSO. Here’s what they can do:

-

Promote a Strong Control Culture – Partner with executives to set the right tone at the top.

-

Educate Employees – Provide regular training on internal controls and their importance.

-

Leverage Technology – Use GRC platforms to automate risk assessments, monitoring, and reporting.

-

Conduct Gap Analyses – Regularly compare current practices against COSO’s 17 principles.

-

Integrate with Enterprise Risk Management (ERM) – Ensure COSO aligns with broader ERM strategies.

-

Engage the Board – Provide transparent updates to the board and audit committee.

COSO in Action: Real-World Examples

-

Financial Institutions: Use COSO to strengthen internal controls over complex financial reporting and reduce fraud risks.

-

Healthcare Organizations: Apply COSO to protect patient data, comply with HIPAA, and safeguard against billing fraud.

-

Energy and Utilities: Adopt COSO to comply with NERC/FERC requirements and ensure operational continuity.

-

Technology Companies: Leverage COSO for IT controls, data governance, and cybersecurity.

How can VComply help?

The COSO framework is extremely crucial for enhancing business operational efficiency and establishing stringent internal controls. But, due to its inherently complex nature and add-on intricacies, you would require a helping hand from the industry experts to seamlessly integrate this across your organization.

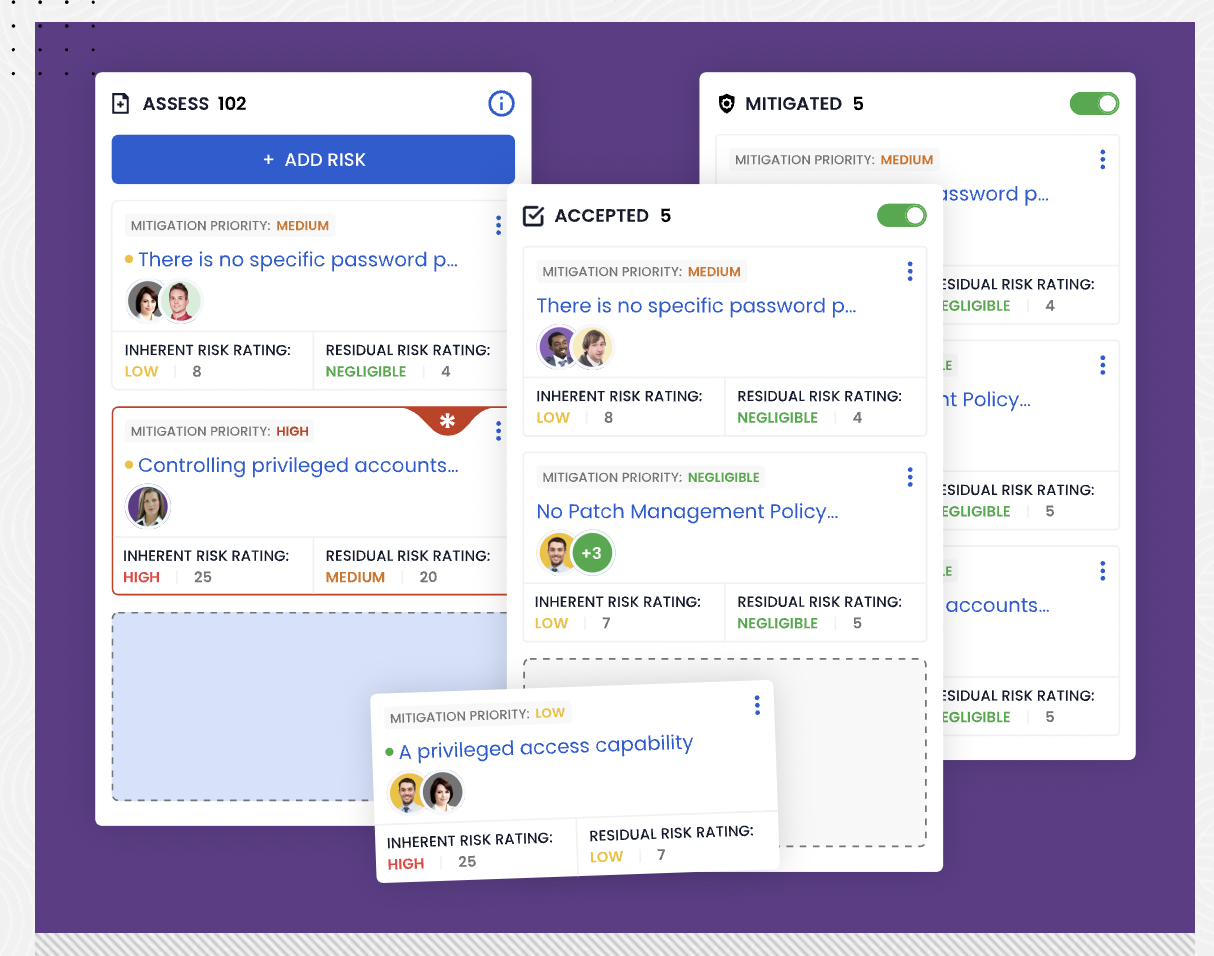

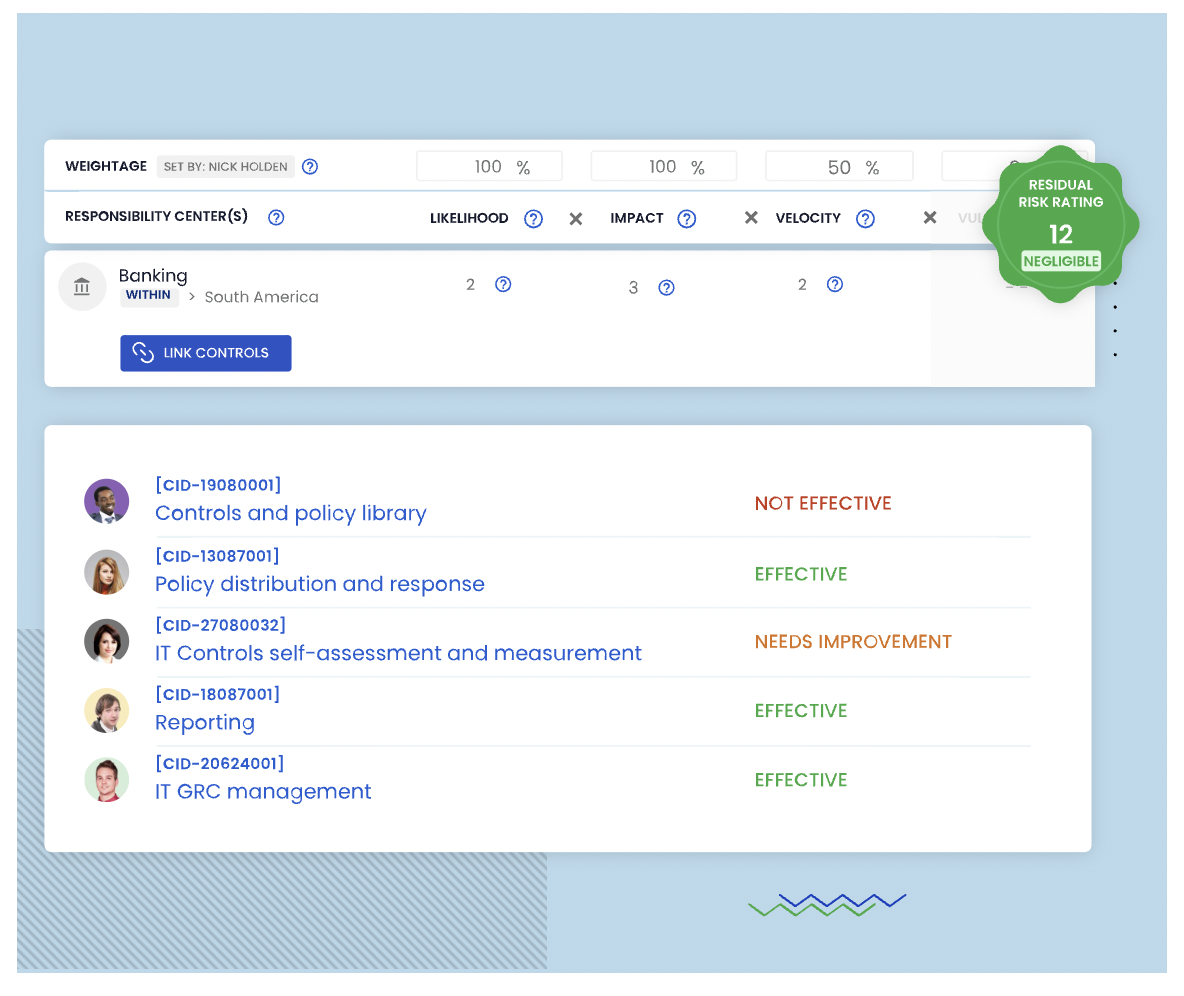

VComply supports the COSO framework and helps organizations design and implement internal controls so they can focus on legal compliance and improving organizational effectiveness. It provides a core library with a pre-built compliance framework and change-control capabilities that enable companies to identify, assess, manage, and monitor their risks.

Key highlights of VComply’s product capabilities include:

#1. Improves your risk management

VComply’s central library has predefined controls and supports a reusable risk register. You can implement workflows to streamline the risk management process. Its workflow capabilities allow you to prioritize risks with heat maps, reports, and dashboards.

#2. Reduce operational risks by harnessing granular insights

VComply’s COSO enterprise risk management solution visualizes the risk landscape of your organization. You can map controls to risk, develop new controls, and monitor the effectiveness of controls in real-time. Lastly, you can track and implement remediation processes across the organization.

Using the COSO framework, businesses have more prescriptive internal controls in place to reduce risks and make smarter business decisions. Implementing the framework allows your organization to build and maintain internal controls that are effective, leading to greater reliability, relevance, and timeliness.

To summarize, internal controls based on the COSO framework give companies a reasonable level of assurance that it is conducting business more openly, morally, and in compliance with industry regulations.

Explore what makes VComply a consistent G2 high performer in Compliance Management. Request your demo today and transform your approach.

Frequently Asked Questions

1. What is the COSO Framework?

The COSO Framework, developed by the Committee of Sponsoring Organizations of the Treadway Commission, is a model that helps organizations design, implement, and evaluate internal controls to achieve reliable reporting, effective operations, and compliance with laws and regulations.

2. Why is the COSO Framework important?

It provides a globally recognized standard for internal controls, reduces the risk of fraud, improves financial reporting reliability, and ensures organizations meet regulatory requirements such as the Sarbanes–Oxley Act (SOX).

3. What are the five components of the COSO Framework?

The five components are:

-

Control Environment

-

Risk Assessment

-

Control Activities

-

Information and Communication

-

Monitoring Activities

4. What are the 17 principles of COSO?

The 17 principles expand the five components into actionable practices, such as demonstrating integrity, analyzing risks, developing policies, using relevant information, conducting evaluations, and communicating deficiencies.

5. Who should use the COSO Framework?

Publicly traded companies (especially those subject to SOX), but also private companies, nonprofits, and government agencies can benefit from applying COSO to strengthen governance and accountability.

6. How does COSO relate to SOX compliance?

SOX Section 404 requires companies to assess the effectiveness of internal controls over financial reporting. The COSO Framework is widely accepted as the standard model for meeting this requirement.

7. What are the benefits of using COSO?

Key benefits include: improved risk management, stronger fraud detection, efficient operations, enhanced compliance, better investor confidence, and reliable financial reporting.

8. What challenges do organizations face in implementing COSO?

Common challenges include the cost of implementation, cultural resistance to change, maintaining ongoing monitoring, and adapting controls to digital transformation risks like cybersecurity.

9. How often should organizations evaluate their COSO controls?

Controls should be monitored continuously through automated systems and periodically reviewed through audits or separate evaluations to ensure ongoing effectiveness.

10. Can COSO be integrated with other frameworks?

Yes. COSO can be integrated with frameworks like COBIT for IT governance, ISO standards for quality and security, and enterprise risk management (ERM) practices for a more holistic compliance and risk strategy.